Hope you had benefited from 4 Nov trading homework. Many warning signs that i’ve noted from 4 Nov trading homework are slowly crystallising in the last trading week. Let’s take a look at which are those.

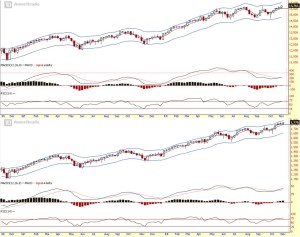

On the monthly, note/sign 1 says Dow is moving in tandem as S&P, but it is moving slower than S&P. Usually when that happen, the market continues to move higher until both are in sync.

Week of 4th Nov: Dow is catching up with S&P. In fact, Dow over-performed S&P during last trading week. On the weekly, S&P did wait for Dow to catch up, and now both Dow and S&P are above resistance level.

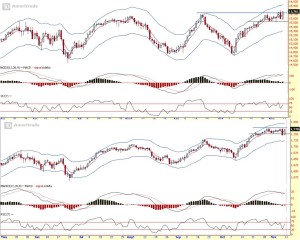

On the daily, 4 Nov homework said price will range within the boundary, or trend slightly higher but volatile. By end of the week, both Dow and S&P are still within a range. Away from short term support, at the edge of resistance (Dow slightly above resistance level).

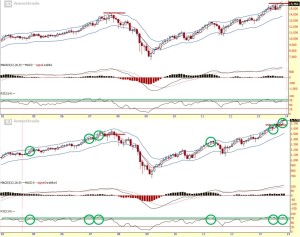

VIX (Fear index) weekly and daily is still near the bottom of its support zone. 4 Nov homework said VIX might repeat what it did in July – Aug (refer to blue circled zone on the chart). July – Aug, it did a spike, retest the bottom before taking off. Right now, it looks like it is doing a flight. Yet to confirmed if Jul – Aug pattern is repeating. Let’s continue to monitor the moves for the next few weeks.

Summary:

Long term (monthly chart):

UP (overbought)

Mid term (weekly chart):

UP (overbought)

Short term (daily chart):

UP (not overbought yet)

The trend is UP in all three time frames. If the trend is your friend, stay long. But I continue to believe:

1) prices will stay range bound – slightly to the higher end since daily chart suggest prices are not over cooked yet)

2) but volatile fashion until either

2a) VIX breaks support (below green box on daily chart shown – which will signal another extremely bullish move), or

2b) VIX breaks resistance (the red line in between the green box on daily chart – which will signal a pullback coming).

Cheers

Strongerhead ways to becoming a better trader

NOTE: All information provided “as is” for informational purposes only, not intended for trading purposes or advice.